THE GOVERNMENT IS PROFITING ON DEFAULTED STUDENT LOANS

Summary

Suppose it was discovered that B of A, JP Morgan Chase, and other banks had actually been making, not losing money on defaulted subprime home mortgages, and in fact made more money when the loans defaulted than if they remained in good stead. Now, suppose further that it turned out that Fannie Mae had a similar perverted financial motivation that gave it a clear preference for loans to default. Finally, suppose that even the Federal Housing Administration actually realized a net profit on defaulted subprime home loans. This is, in fact, precisely analogous to what is happening, and has been happening for years for defaulted, FFELP, student loans- which comprise the large majority of all student loans, nationally.

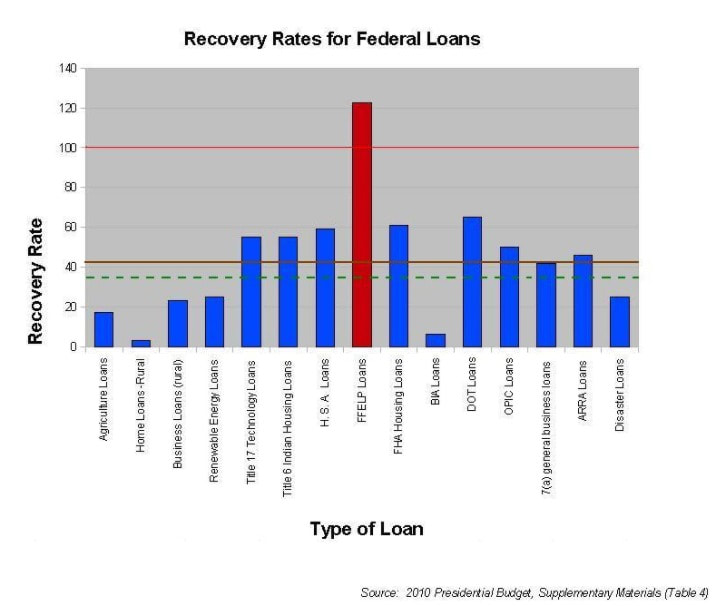

Supplemental materials in the president’s 2009, 2010, 2011 budgets (and prior) show that for every dollar paid out by the federal government for defaulted Federal Family Education Loan Program (FFELP) student loans (which comprise a large majority of all outstanding student loans), the Department of Education recovers $1.22 (we assume this is before collection costs, and the government’s “cost of money”) . Compare this recovery rate to that for defaulted credit cards, which is usually about 10 cents on the dollar, and one can see that defaulted loans are clearly not costing the Department of Education money. In fact, it appears strongly that the reverse is true. Comparison of the defaulted student loan recovery rate with those for other federal loans shows a hugely exaggerated rate for student loans, and only for student loans. Furthermore, analysis shows conclusively that indeed, the federal government is making more money on defaulted FFELP loans than for non defaulted loans, signifying a clear preference for the former over the latter. This is a defining characteristic of a predatory lending system.

Comparing defaulted student loan collections to typical, industry standards

Consider the case of generalized defaulted bank loans. Dermine and Neto de Carvalho (2006) found that these loans incurred, on average, a recovery cost of about 2.6% of the amount recovered. So for example: to recover $122,000 in defaulted bank loan debt would cost about $3,500.

It is important to note that for general bank loans (ie home loans, car loans, property loans, etc), recovery typically involves the seizure of physical property pledged against the loan- property that must be handled, stored, and ultimately liquidated by the bank. This, combined with the various legal and administrative costs that accompany such recovery action is a significant cost that does not exist for unsecured debts, such as student loans or credit cards.

Consider that student loans are not dischargeable in bankruptcy. Nor are they subject to statutes of limitations, state usury laws, or even Fair Debt Collection Practices when the collection entity is a non-profit, government-sponsored (or government) entity. Consider further that the student lending system can take a borrowers wages, income tax returns, Social Security and Disability income, and can also put pressures on a borrower that no credit card company could bring to bear, such as termination/exclusion from public employment, denial of security clearances, exclusion from practicing in a state licensed profession through administrative suspension, and others. Credit card recovery is probably far more expensive than recovery of defaulted student loans, yet apologists for the student lending system would have us believe that the reverse is true.

These powers, and lack of consumer protections combine to show clearly that the collection costs associated with defaulted student loan recovery should be far, far less, even, than the costs associated with the recovery of defaulted credit card debt., particularly given that for decades, the federal student aid office has been managed by executives who were brought in from private industry lending companies like Sallie Mae, in order to streamline processes, control costs, and otherwise make it run “like a business”.

Given that the Department recovers 22% more than it pays out on default claims, the only way the federal government could not be making money on these loans is if the collection costs incurred amounted to approximately 20% (we assume a nominal “cost of funds” allowance here).. Given that defaulted credit cards will typically see a 6-10% recovery rate, the associated collection costs for these cards has got to be significantly less than this- probably no more than 3%. Given this, and the relative difficulty and expense associated with collecting on credit cards compared to student loans, it would be virtually impossible to credibly claim that collection costs on student loans could be anywhere near 20%.

This, however, appears to be what the Department of Education would like to claim. For example, a recent article in the WSJ intimates that the government is indeed “losing money”on defaulted loans. It appears to claim that the department ultimately loses 15%, rather than gains 22%, due to collection costs. So, according to this logic (and assuming the government’s cost of funds is nominal), This means that to collect $122,000 in defaulted student loan debt costs the Department of Education about $37,000, or, about 37% of the value of the loan at the time of default.

Comparing defaulted FFELP loans to non-defaulted loans.

To be thorough, let us consider this question from a slightly different basis, and consider narrowly whether a rational decision maker in the role of FSA would prefer a loan to default, or not. In other words, let’s compare a defaulted loan to a non-defaulted loan, and see if there is a clear financial incentive to prefer one over the other from the standpoint of the Department of Education.

From the Department’s perspective, an FFEL loan can either default, or remain in good stead. Given no specific details about the loan, the borrower characteristics, etc., the Department has a very simple choice to make:

1. The loan remains in good stead.

This is the simplest case, The Department pays subsidies if required during the life of the loan, and also either pays or receives “spread income” to or from the lender (this is a complicated mechanism, but generally these payments are made by the Department to the lenders). So the Department pays no default claim, and may incur interest subsidy, and generally pays a small “spread cost”. To be overly generous, we will simply ignore these costs for the purpose of this analysis. So the Department, essentially, just “watches the loans go by”, and there are no costs involved, nor income gained.

2. The loan defaults,

The Department must pay out principal and interest of the loan at the time of default. Assuming the government’s “cost of money” is small we know that ultimately the Department recovers 122% of this original payout amount. Even if collection costs were twice that of general bank loans, this would still leave a hefty profit for the Department of Education.

So essentially, the Department is given a choice: Either do nothing and get nothing, or outlay cash with the knowledge that this outlay will realize a 22 percent return, ultimately (minus the governments cost of money and collection costs). From this perspective, it is clear that based solely on financial motivations, and without specific detailed knowledge of the loan (i.e. borrower characteristics, etc.), the chooser would clearly favor the default scenario, for not only the return, but perhaps the potential savings in subsidy payment as well,

Conclusion

It should be clear from this analysis that for many years, the Department of Education MUST have looked upon defaulted FFELP loans as a source of revenue, rather than a cost to the agency. Given a current defaulted loan portfolio of approximately $60 billion, the amount of revenue this represents to the Department of education is in the tens of billions of dollars. Claims by supporters of the Department of Education ,and by the Department of Education itself to the contrary are simply not credible.

This is critically important because fiscal concerns tend to guide and shape policy and procedures within the Federal Student Aid Office, or any government agency, for that matter. Seeing defaulted loans as a fiscally desirable outcome creates an obvious and egregious oversight conflict that, if left uncorrected, leads to behaviors that tend to hurt, rather than help the students in all areas, including providing critical, accurate information to Congress, who has ultimate authority on lending limits, and thus controls the cost of tuition by controlling these limits. Ultimately, this causes Great harm to citizens and their families.

There is clear and obvious evidence that the Office of Federal Student Aid has, over time, adopted policies that hurt, rather than help students, There is also clear evidence that the Office of Federal Student Aid acted in such a manner (by both actions, and inactions) that ultimately led to increased borrowing, higher college prices, and a higher default rate.

At the core of this problem lies the fact that nearly all standard consumer protections have been stripped from federal student loans. Despite the rhetoric offered up by apologists for the student loan system (this includes so-called “student advocates”), federal loans have in fact, far fewer consumer protections than even private, non-federally guaranteed student loans. This has set up a predatory lending situation that simply must be corrected by returning, at a minimum, standard bankruptcy protections to all student loans. Conservatives and liberals alike must agree with this statement, and Congress must act accordingly, and immediately.

Consider the case of generalized defaulted bank loans. Dermine and Neto de Carvalho (2006) found that these loans incurred, on average, a recovery cost of about 2.6% of the amount recovered. So for example: to recover $122,000 in defaulted bank loan debt would cost about $3,500.

It is important to note that for general bank loans (ie home loans, car loans, property loans, etc), recovery typically involves the seizure of physical property pledged against the loan- property that must be handled, stored, and ultimately liquidated by the bank. This, combined with the various legal and administrative costs that accompany such recovery action is a significant cost that does not exist for unsecured debts, such as student loans or credit cards.

Consider that student loans are not dischargeable in bankruptcy. Nor are they subject to statutes of limitations, state usury laws, or even Fair Debt Collection Practices when the collection entity is a non-profit, government-sponsored (or government) entity. Consider further that the student lending system can take a borrowers wages, income tax returns, Social Security and Disability income, and can also put pressures on a borrower that no credit card company could bring to bear, such as termination/exclusion from public employment, denial of security clearances, exclusion from practicing in a state licensed profession through administrative suspension, and others. Credit card recovery is probably far more expensive than recovery of defaulted student loans, yet apologists for the student lending system would have us believe that the reverse is true.

These powers, and lack of consumer protections combine to show clearly that the collection costs associated with defaulted student loan recovery should be far, far less, even, than the costs associated with the recovery of defaulted credit card debt., particularly given that for decades, the federal student aid office has been managed by executives who were brought in from private industry lending companies like Sallie Mae, in order to streamline processes, control costs, and otherwise make it run “like a business”.

Given that the Department recovers 22% more than it pays out on default claims, the only way the federal government could not be making money on these loans is if the collection costs incurred amounted to approximately 20% (we assume a nominal “cost of funds” allowance here).. Given that defaulted credit cards will typically see a 6-10% recovery rate, the associated collection costs for these cards has got to be significantly less than this- probably no more than 3%. Given this, and the relative difficulty and expense associated with collecting on credit cards compared to student loans, it would be virtually impossible to credibly claim that collection costs on student loans could be anywhere near 20%.

This, however, appears to be what the Department of Education would like to claim. For example, a recent article in the WSJ intimates that the government is indeed “losing money”on defaulted loans. It appears to claim that the department ultimately loses 15%, rather than gains 22%, due to collection costs. So, according to this logic (and assuming the government’s cost of funds is nominal), This means that to collect $122,000 in defaulted student loan debt costs the Department of Education about $37,000, or, about 37% of the value of the loan at the time of default.

Comparing defaulted FFELP loans to non-defaulted loans.

To be thorough, let us consider this question from a slightly different basis, and consider narrowly whether a rational decision maker in the role of FSA would prefer a loan to default, or not. In other words, let’s compare a defaulted loan to a non-defaulted loan, and see if there is a clear financial incentive to prefer one over the other from the standpoint of the Department of Education.

From the Department’s perspective, an FFEL loan can either default, or remain in good stead. Given no specific details about the loan, the borrower characteristics, etc., the Department has a very simple choice to make:

1. The loan remains in good stead.

This is the simplest case, The Department pays subsidies if required during the life of the loan, and also either pays or receives “spread income” to or from the lender (this is a complicated mechanism, but generally these payments are made by the Department to the lenders). So the Department pays no default claim, and may incur interest subsidy, and generally pays a small “spread cost”. To be overly generous, we will simply ignore these costs for the purpose of this analysis. So the Department, essentially, just “watches the loans go by”, and there are no costs involved, nor income gained.

2. The loan defaults,

The Department must pay out principal and interest of the loan at the time of default. Assuming the government’s “cost of money” is small we know that ultimately the Department recovers 122% of this original payout amount. Even if collection costs were twice that of general bank loans, this would still leave a hefty profit for the Department of Education.

So essentially, the Department is given a choice: Either do nothing and get nothing, or outlay cash with the knowledge that this outlay will realize a 22 percent return, ultimately (minus the governments cost of money and collection costs). From this perspective, it is clear that based solely on financial motivations, and without specific detailed knowledge of the loan (i.e. borrower characteristics, etc.), the chooser would clearly favor the default scenario, for not only the return, but perhaps the potential savings in subsidy payment as well,

Conclusion

It should be clear from this analysis that for many years, the Department of Education MUST have looked upon defaulted FFELP loans as a source of revenue, rather than a cost to the agency. Given a current defaulted loan portfolio of approximately $60 billion, the amount of revenue this represents to the Department of education is in the tens of billions of dollars. Claims by supporters of the Department of Education ,and by the Department of Education itself to the contrary are simply not credible.

This is critically important because fiscal concerns tend to guide and shape policy and procedures within the Federal Student Aid Office, or any government agency, for that matter. Seeing defaulted loans as a fiscally desirable outcome creates an obvious and egregious oversight conflict that, if left uncorrected, leads to behaviors that tend to hurt, rather than help the students in all areas, including providing critical, accurate information to Congress, who has ultimate authority on lending limits, and thus controls the cost of tuition by controlling these limits. Ultimately, this causes Great harm to citizens and their families.

There is clear and obvious evidence that the Office of Federal Student Aid has, over time, adopted policies that hurt, rather than help students, There is also clear evidence that the Office of Federal Student Aid acted in such a manner (by both actions, and inactions) that ultimately led to increased borrowing, higher college prices, and a higher default rate.

At the core of this problem lies the fact that nearly all standard consumer protections have been stripped from federal student loans. Despite the rhetoric offered up by apologists for the student loan system (this includes so-called “student advocates”), federal loans have in fact, far fewer consumer protections than even private, non-federally guaranteed student loans. This has set up a predatory lending situation that simply must be corrected by returning, at a minimum, standard bankruptcy protections to all student loans. Conservatives and liberals alike must agree with this statement, and Congress must act accordingly, and immediately.